With the first day of school already upon us, making a good impression is top priority no matter who you are. Students carefully pick out their snazziest outfits, while internet retailers serve up their most influential content – customer opinions.

Between June and August, certain product categories are as hot as the summer sun. Spend on traditional school supplies is up 29% from last year. Retailers in the consumer electronics and office supplies industries ramp up their campaigns to help shoppers make better purchase decisions with user-generated content (UGC). But did they do it early enough? If they heeded market research and traditional back-to-school shopping assumptions, they may not have.

Online research happened earlier than expected

This season, Google asked a sample of shoppers when they expected to do their back-to-school research. The findings suggested that research would peak in mid-July, before the purchasing peak in August. This timeline is expected. I would probably give similar answers to the same survey myself. But does the actual data match these responses?

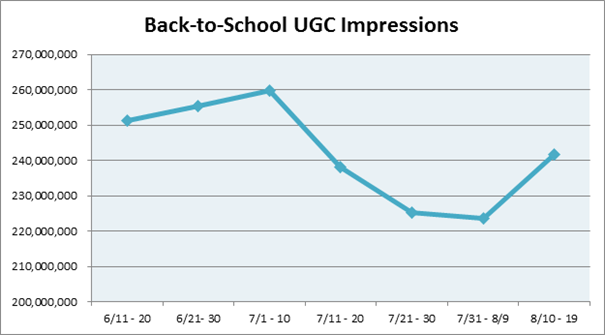

Actually, no. Impressions data for reviews and Q&A content across a sample of our top consumer electronics and office supplies retailers validates the expected dip, but it came a few weeks before the Google study predicts.

Shoppers did their research even earlier than they said they would. Market researchers need to neutralize response bias – which is when subjects shape their responses to match the study’s expected findings – and look at the real data. Shoppers this year used reviews, asked questions, and read answers from consumers and brand reps alike to get information about back-to-school products as early as mid-June!

Retailers who were prepared for these early researchers and had a site stocked with UGC surely benefited. During the back-to-school season last year, visitors who reached a consumer electronics or office supplier product page converted 37% more if they interacted with review content. Similarly, revenue per visit in these industries increased 28% and 48%, respectively, when site visitors read reviews. And these stats are only for those single-session buyers, who were quick to make a purchase decision. Imagine the cross-session and in-store impact – which are more difficult to capture – on items such as laptops, which 30% of parents said they’ll buy this year for their children. These higher-consideration items are likely to require multiple trips to the product page, and perhaps result in an in-store purchase after much online research.

Mobile adoption makes UGC portable

It is becoming increasingly important to have simple, beautiful user experiences for on-the-go students and parents who are hungry for information. Mobile sales grew by 63% from 2011 to 2012, and one third of moms say mobile accounts for half of their shopping time or more.

We saw this mobile influence among back-to-school shoppers in our network. The Bazaarvoice network serves 369,000 impressions every minute. Sixteen percent of these impressions of reviews and Q&A are not displayed on the product page by default, but are actively requested by the visitor through pagination. From June to mid-August this year, 15% of product pageviews in back-to-school industries were with a tablet or smartphone.

With nearly four in ten (37%) people saying they would cut back-to-school spending this year, the data shows that opinions from other parents, students, and teachers played a large role in deciding how to spend that smaller budget. And via mobile, that influence affects online and offline sales alike.

As one important shopping season wanes, another begins; Black Friday and the start of the holiday season is fast approaching. Learn from the back-to-school data to prepare for success throughout the close of the year, and put UGC at the center of your selling strategies — perhaps even sooner than you think you should.